Canadian institutional investors invest billions of dollars in oil and gas companies, many claiming to be committed to using their influence as shareholders to push for net zero alignment. But we are calling their bluff.

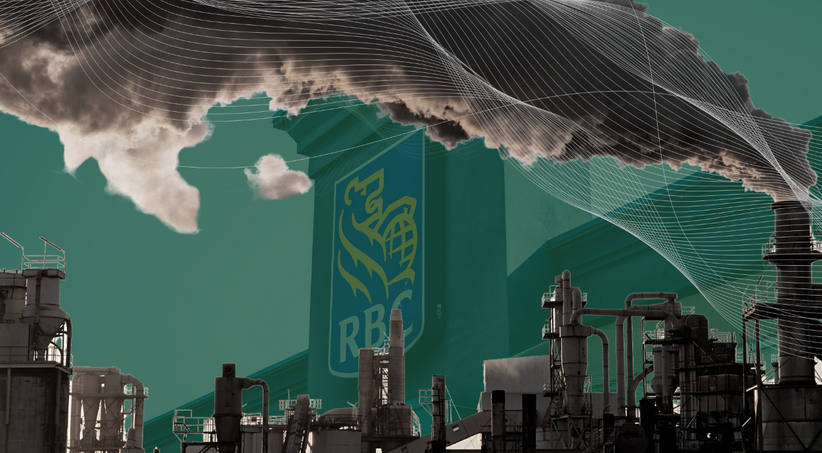

For example, RBC Global Asset Management — Canada’s largest asset manager — is a major investor in oil sands majors while also advertising its membership in the investor-led initiative Climate Engagement Canada to shareholders and prospective clients. The logic they assert is that their real world influence on climate risk management in oil and gas companies is more powerful as an investor than if they divested.

And yet, last year, despite clear pullback by Canada’s oil sands companies on their net zero commitments, we were strangely alone (with one important exception) standing up at their AGMs asking them to follow through on their net zero commitments.

So, we dropped the gauntlet. Last year, we took out a full-page ad in the Globe & Mail challenging institutional investors to follow through on their climate engagement commitments at oil and gas majors. We explained that we were no longer going to do the work for them and provide cover since “someone else” was doing it, even though it is the institutional investors who hold the real sway.

The results are in. The 2025 Canadian oil and gas sector AGM season has come to a close and there is no evidence that any institutional investor accepted our challenge. No shareholder resolution promoting improved climate risk management was brought at any of the largest oil and gas companies in Canada — Suncor, CNRL, Cenovus, TC Energy, or Imperial Oil.

We are told that conversations have been happening behind closed doors; but the proof is in the pudding:

- There is in fact no energy transition among Canadian oil and gas companies; on the contrary, production is increasing;

- Related, as further proof of transition failure, oil company revenues are being returned to investors as dividends rather than invested in net-zero aligned Capex;

- The oil and gas industry is loudly pushing for massive environmental deregulation and major new fossil fuel infrastructure; and

- Climate-related commitments and disclosures are decreasing.

And so, we are calling the bluff of Canadian asset managers, as it seems the oil sands companies have already done.

If engagement is to remain a core part of asset managers’ net zero strategies, we need to see the proof they are serious, and right now there is none. The claims about “having a seat at the table” are akin to greenwashing when there is no progress. Indeed, we are going backwards.

So what then? We are calling for honesty among institutional investors claiming to be engaging with oil and gas companies to drive net zero alignment. Either stop claiming that the status quo equates to legitimate engagement with Canadian oil sands companies, or use your muscle as major shareholders to drive change by either filing shareholder resolutions or voting against the election of responsible directors, along with the real threat of divestment if action is not taken.

To be clear, these investors hold significant sway. For example, as of February 2025, Suncor investors that are also members of Climate Engagement Canada held over 20% of company shares.

It’s time investors step up, or step out and divest. Or admit they have no serious net zero plan.