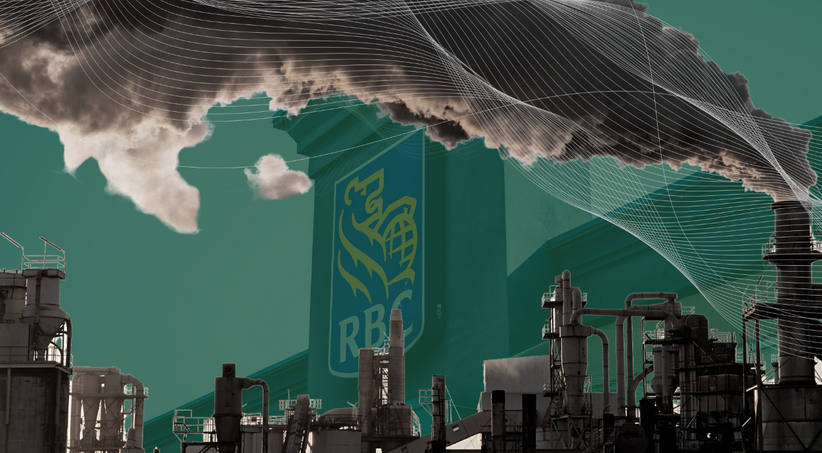

$2 trillion ESG business segment held up by banks as net zero strategy, without proof

(Toronto, ON; Tuesday January 9, 2024) Today the shareholder advocacy group Investors for Paris Compliance lodged a securities complaint with the Ontario Securities Commission and the Autorité des marchés financiers of Québec alleging misleading disclosure by Canada’s big five banks regarding their sustainable finance activity. RBC is registered in Québec while BMO, CIBC, Scotiabank and TD are registered in Ontario.

Each of the five banks has made a sustainable finance – or some similarly worded – commitment in the hundreds of billions of dollars and lists this as a central way it will reach its net zero target, yet none discloses the emissions impact of deals in this business segment and the complaint documents several instances where sustainable finance deals have increased instead of reduced emissions.

“At best, sustainable finance as currently practiced by Canada’s big banks is a $2 trillion placebo at a time when we need strong medicine to reduce emissions,” said Matt Price, Executive Director with Investors for Paris Compliance. “At worst, it is greenwashing of carbon-intensive businesses, misleading investors and the public.”

The complaint documents:

-

Canada’s securities regulators, via the Canadian Securities Administrators, have clarified that ESG disclosure is subject to the same rules of accuracy and completeness as financial disclosure, and have flagged concerns regarding greenwashing.

-

Each of the banks has acknowledged climate change poses significant risk to their business, and therefore to their securities holders.

-

Each of the banks has made a net zero commitment and lists sustainable finance – or something similarly worded – as a central way they will meet its commitment.

-

Yet, there is no disclosure of the emissions impact of deals in this business segment, meaning there is no practical distinction with the banks ‘regular’ financing.

-

Worse, there are several examples of deals done under this label increasing rather than decreasing emissions – this is greenwashing and exposes the absence of rules governing the segment.

-

Bank securities holders are therefore being misled as to the nature of the banks’ response to the business risk that climate change represents.

Securities regulators have the authority to initiate investigations, require corrective disclosure, or issue specific guidance. The complaint asks for such guidance regarding ESG-labeled bonds, which form part of the sustainable finance.

Other studies have similarly found shortcomings with Canadian bank climate financing. A recent BloombergNEF report found Canada’s banks to have some of the worst ratios of low-carbon to fossil-fuel financing in the world.

“Securities regulators in Canada have expressed a general concern with greenwashing, and now investors need them to follow through with specific action to protect bank securities holders,” said Price. “Meanwhile, we need the banks to get serious about shifting finance out of fossil fuels and into ventures that reduce emissions.”

-30-