Canada’s major banks have committed to going “net zero” by 2050 in their financed emissions. To date these commitments have been voluntary, with serious questions arising about whether the banks will ever be inclined to leave money on the table made by financing the fossil fuel industry.

In terms of implementation, we have seen relatively weak policy efforts so far. Meanwhile, the banks are accelerating their fossil fuel financing, taking them further away from net zero rather than closer.

Part of the challenge is lack of clarity and consensus regarding what credible net zero plans look like for financial institutions, allowing the banks to set their own low bar.

That’s starting to change, with several sets of relevant guidance released over the past weeks that will start to tighten up interpretations. Let’s explore three such efforts, which range from the most binding and weakest in nature to the least binding and strongest in nature.

1. OSFI’s Draft Guideline on Climate Risk Management

When Canada’s bank regulator says something, the banks must listen. It’s too bad then that the regulator continues to be so timid when it comes to regulating climate risk.

The Office of the Superintendent of Financial Institutions (OSFI) has released a draft guideline for comment regarding climate risk management. To date, OSFI refuses to consider what’s known as “double materiality” – that is, it is entirely concerned with how the climate crisis will impact financial institutions rather than how the same institutions are accelerating that crisis with their own actions. This is leading to what some call a “Climate Lehman Moment” as financial institutions undermine the conditions of their own survival by fostering systemic risk via their financing of fossil fuels.

The result is a weak OSFI guideline that amounts to “have a plan” and “disclose relevant information.” There are no metrics that define what a credible plan would look like, just a series of principles open to wide interpretation. Regarding disclosure, OSFI does helpfully codify that the banks need to be using the Partnership for Carbon Accounting Financials’ (PCAF’s) standard or equivalent for calculating Scope 3 emissions and name checks the International Sustainability Standards Board’s Exposure Draft on Climate Related Disclosures while notably not the weaker effort by the Canadian Securities Administration.

Overall, OSFI is catching up to where the major banks are already at, although this does provide a backstop on some disclosure issues, for example, if a bank claims to be following PCAF but isn’t in practice.

2. GFANZ’ Financial Institution Net-zero Transition Plans

The Glasgow Financial Alliance for Net Zero (GFANZ) is the umbrella organization established by Mark Carney and Mike Bloomberg that includes subsets of financial institutions such as the Net Zero Banking Alliance (NZBA) that Canada’s big banks joined as a group last year.

While membership in these bodies is voluntary, they do issue membership criteria and guidance to members regarding implementation. There is some moral suasion underpinning the criteria and guidance in that banks don’t want to be perceived to not living up to their commitments. OSFI also name checks the NZBA in its draft guidance, indicating that it is monitoring its progress.

GFANZ recently released recommendations and guidance regarding net zero transition plans for financial institutions. Like OSFI, GFANZ steers away from the specific metrics and red lines we need to drive the necessary change on a timeline consistent with climate science, but it does at least get into transition issues, including the accelerated phaseout of high-emitting assets. It also advocates alignment with 1.5 degrees, whereas OSFI only talks about disclosing resilience against various scenarios, “including a 2 degree C or lower.”

The guidance explores 10 recommendations ranging from setting objectives to developing products to target setting to roles and remuneration. Much of the content is relatively straightforward, if vague, but these things stood out:

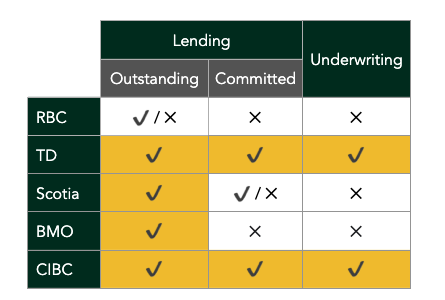

- Under policies and conditions, GFANZ talks about tackling priority sectors such as thermal coal, oil and gas, and deforestation. It gives examples of financial institutions around the world doing this, with no Canadian examples since Canada’s banks are very weak in this regard.

- Under engagement strategy, GFANZ talks about having an escalation framework when dealing with clients or investees. We hear a lot from Canadian banks about “working with” clients on decarbonization, but to date this is a black box with no information about what this looks like, and, critically, no talk about accountability – no “escalation” to ensure progress.

- In its government and public sector guidance, GFANZ talks about aligning direct and indirect lobbying with net zero. This has been a pain point with Canadian banks whose CEOs routinely cheerlead for fossil fuel expansion projects that take us further from net zero. To date no Canadian bank has formalized support for net zero in their lobbying policy – although Scotiabank did recently leave the Canadian Association of Petroleum Producers, which is a start.

3. Race to Zero Revised Membership Criteria

Race to Zero is an initiative of the UN climate convention that rallies businesses, cities, regions and others around climate action. GFANZ is a member of the Race to Zero, as are its sectoral alliances like the NZBA. In its 2021 Progress Report, GFANZ says that “all GFANZ members must align with the Race to Zero criteria.”

Race to Zero just updated its membership criteria, dividing them into “starting line” (minimum) and “leadership practices.” The starting line criteria include setting interim targets for “a fair share of the 50% global reduction in CO2 by 2030” and recognizing we need “phasing down and out all unabated fossil fuels as part of a global just transition.”

In the Interpretation Guide, Race to Zero says “members must restrict the development, financing, and facilitation of new fossil fuel assets in line with appropriate scenarios.” Note that this is in line with the International Energy Agency’s Net Zero pathway, and something that Canadian banks have so far refused to do.

The Interpretation Guide also provides a counterpoint to overwhelming use of intensity-based 2030 targets by Canadian banks: “In most cases, absolute emissions targets are necessary for ensuring real-world reductions. However, there are certain areas in which intensity-based metrics are also appropriate, such as for sectors for which absolute growth is needed to drive decarbonization (e.g. renewable energy).”

Existing Race to Zero members (like GFANZ and the NZBA and their members) have until June 2023 to comply with the new membership criteria, or risk being removed by an accountability mechanism in development.

This sets up a showdown with unpredictable results. Canada’s banks – and indeed perhaps most GFANZ participants – are widely out of step with thew new Race to Zero membership criteria. We may see an “Emperor Has No Clothes” moment by GFANZ next year should it decide to break with the UN climate convention process rather than insist that its members comply.