Nobody should doubt just how much influence Canada’s big banks have over national politics. The Globe and Mail has reported on the direct access that bank CEO’s have with the Prime Minister and Minister of Finance with whom they share their views on everything from covid restrictions to the use of the Emergencies Act.

In theory, this could help them meet their net zero targets. Banks point out that they cannot reduce their own financed emissions without good public policy. Take their mortgage business, for example: there’s no way for banks to reduce those financed emissions in a timely way without better building codes from the provinces. Banks therefore need to be putting their weight behind getting them.

This is consistent with the growing guidance that banks are receiving from bodies like the Glasgow Finance Alliance for Net Zero (GFANZ) that they are members of. GFANZ guidance for net zero plans says, “Financial institutions engaging with public-sector institutions should proactively include topics that support or enable an accelerated and orderly transition to net zero.”

Catherine McKenna’s UN High-Level Expert Group on the integrity of net zero commitments is even clearer:

“Non-state actors must align their external policy and engagement efforts, including membership in trade associations, to the goal of reducing global emissions by at least 50% by 2030 and reaching net zero by 2050. This means lobbying for positive climate action and not lobbying against it.”

So, do we see Canada’s banks using their large influence to lobby for accelerated transition? In fact, we see the opposite.

This disconnect shows up most visibly in the support that Canada’s big banks give to fossil fuel expansion, even though this takes us further from our net zero goals. Bank CEOs repeatedly voice support for controversial new pipelines, never disclosing that they have a financial interest in doing so. CIBC CEO Victor Dodig goes so far as to call oil and gas Canada’s “family business.”

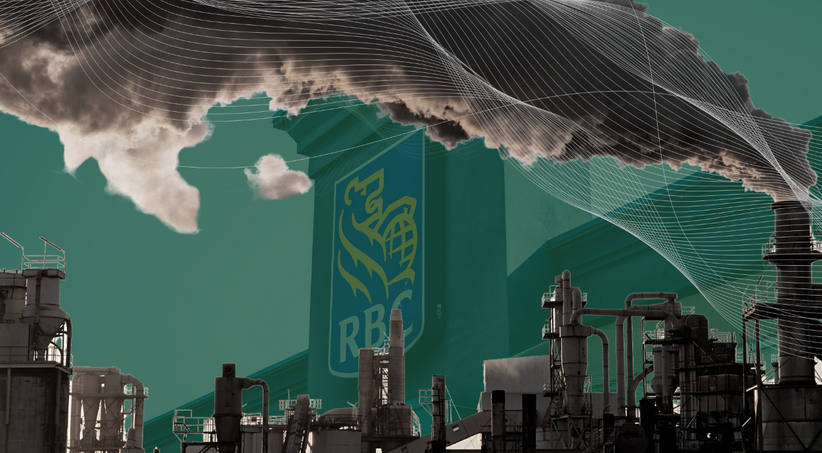

As the climate crisis becomes more apparent, the banks have wrapped their advocacy for fossil fuel expansion in green arguments. RBC labelled its recent call for half a million more barrels a day of oil production “Canada’s New Climate Bargain.” Scotiabank CEO Brian Porter justified his recent call for more fossil fuel infrastructure by talking about “the last barrel.” This is like wanting more cigarettes to cure cancer.

Moreover, Porter admitted during an investor brief that he disagrees with emissions reductions targets for the oil and gas sector and spends a lot of time with policy makers on the topic. Perhaps Porter’s impending retirement as Scotiabank CEO will at least mark an end to this negative lobbying and the bank will turn a corner under new leadership.

Canada’s major banks lobby for more fossil fuels not only directly, but also indirectly via their membership in industry associations. BMO, for example, sits on the Board of the US Chamber of Commerce, rated by Influence Map as obstructionist to climate progress.

It’s hard to take Canadian bank net zero commitments seriously if they are spending lobbying dollars on the opposite. Not only must this end, but we need to see movement in the other direction. Our banks should be updating their lobbying policies to align with net zero, and then implementing practices that support this. We need to see an end to support for industry associations that oppose climate action, and the start of banks taking a stand on the right side of public policy debates.