SUMMARY: The climate crisis is increasing risk and driving negative health outcomes in Canada and around the world. This runs counter to the mission of life and health insurance companies like Sun Life and Manulife.

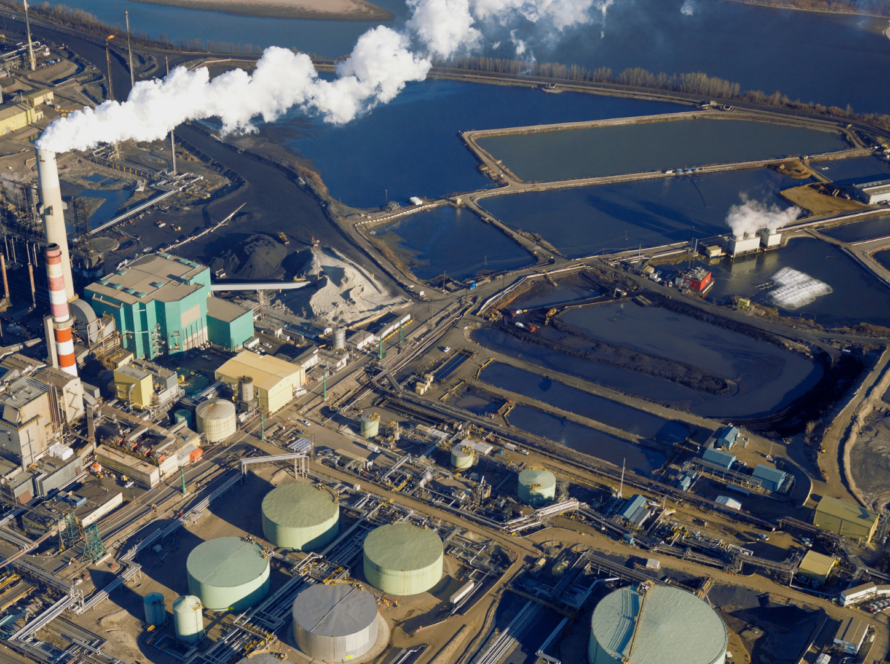

And yet, in their role as major asset owners and managers— a combined $3 trillion—they are making significant investments in fossil fuels, which makes the climate crisis worse. For example, Sun Life and Manulife are the number one and three Canadian investors in coal.

To their credit, Sun Life has committed to achieving net zero by 2050 in their financed emissions, and Manulife has committed to net zero for the insurance premiums they invest. Both are taking steps towards implementation. How far do they have to travel?

We commissioned Profundo to estimate Sun Life and Manulife’s financed emissions based on available data and extrapolations. Because of their large size, the scale of those financed emissions is massive—for each company it’s about equivalent to the combined emissions of Ontario and Quebec. For the two companies added together, it’s about equivalent to three-quarters of Canada’s national emissions.

Read the full report here.