The Institutional Investors Group on Climate Change (IIGCC) just released an analysis of the progress of major banks on net zero, including Canada’s “big 5.” This is significant because IIGCC members collectively have C$66 trillion in assets under management and advice, including actors such as Blackrock, Vanguard, State Street, CalPERS, the CDPQ and many more. These are major shareholders in Canadian banks.

The overall conclusion as stated by IIGCC CEO Stephanie Pfiefer is: “The emerging picture, based on pilot indicators, is of a banking sector that needs to substantially accelerate its decarbonisation efforts to align with a 1.5°C pathway. Given the integral role banks play in directing capital across entire economies, aligning banks’ activities with net zero is key to delivering global decarbonisation.”

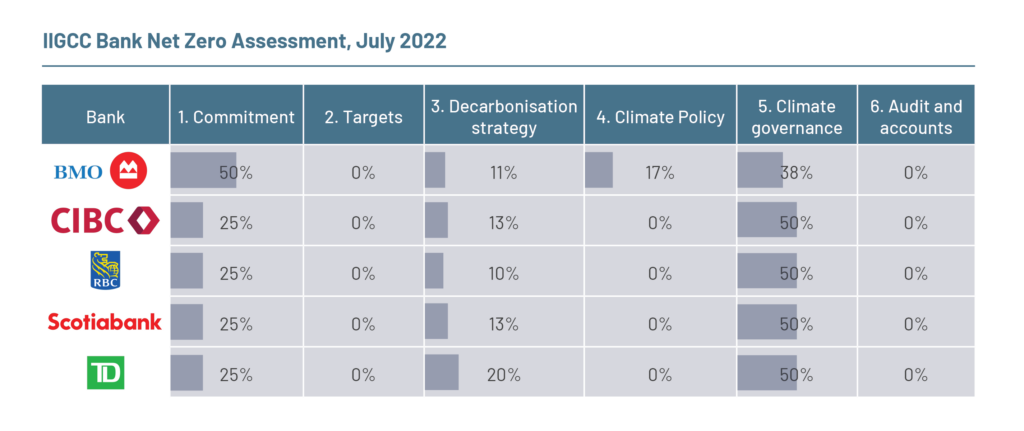

The assessment scored banks on indicators within the following categories:

- Net zero commitments – whether the bank has a commitment to becoming net zero across all its material business segments.

- Short- and medium-term targets – whether the bank has set short (eg. 2025) and medium (eg. 2030) targets for all the sectors it’s involved in.

- Decarbonisation strategies – whether the bank is taking robust action to meet its targets (eg. Client engagement, capital allocation, disclosure of financed emissions, climate scenario analysis).

- Climate governance – whether the bank incorporates climate strategy into its governance and renumeration.

- Climate policy engagement – whether the bank has aligned its direct and indirect lobbying with the goals of the Paris Agreement.

- Audit and accounts – whether the bank captures climate risks in their audited financial statements.

There are things to quibble with in the criteria – such as its agnosticism about intensity vs. absolute targets – but overall, it’s a credible framework. The IIGCC also pushes banks specifically on things like a coal phase out in OECD countries by 2030 and the need to better define “sustainable finance,” which has been one of our core concerns given the greenwashing going on under that label. And, the audits and accounts issue could be revolutionary, moving climate officially onto balance sheets, but probably faces headwinds regarding standardized and available data.

How did Canada’s banks do? Not great really, reflecting the fact that they are either early in their journey and still accelerating, or else stalled out by failing to follow words with action. Here are the Canadian results:

To be fair to the banks, it’s somewhat unclear how IIGCC arrived at some of these scores, so it would be good to see more information about that.

What’s next? The key question is whether IIGCC members will follow up on this assessment and actually push the banks to go further and faster. They can do this via direct and more assertive engagements, and via filing and voting on relevant shareholder proposals, or ultimately by divesting should no progress be forthcoming. Let’s hope they do these things starting now, since the world is on fire and banks continue to supply the fuel.