Insurance companies are on the front lines of the climate crisis. This is most evident with property insurers who end up picking up the tab following extreme weather events – hurricanes, fires, floods, etc – and is behind the reason that these companies are lobbying for better adaptation policies in Canada.

But it’s also true for the health and life insurers like Sun Life and Manulife. BC’s heat dome last year killed 619 people, and a major national assessment of climate and health concluded that “Climate change is already negatively impacting the health of Canadians” and that “Health risks will increase as warming continues, and the greater the warming, the greater the threats to health.” Such impacts threaten to be even worse in Asia where these companies are expanding.

Why then are Canada’s insurance companies making the climate crisis worse by investing so heavily in fossil fuels?

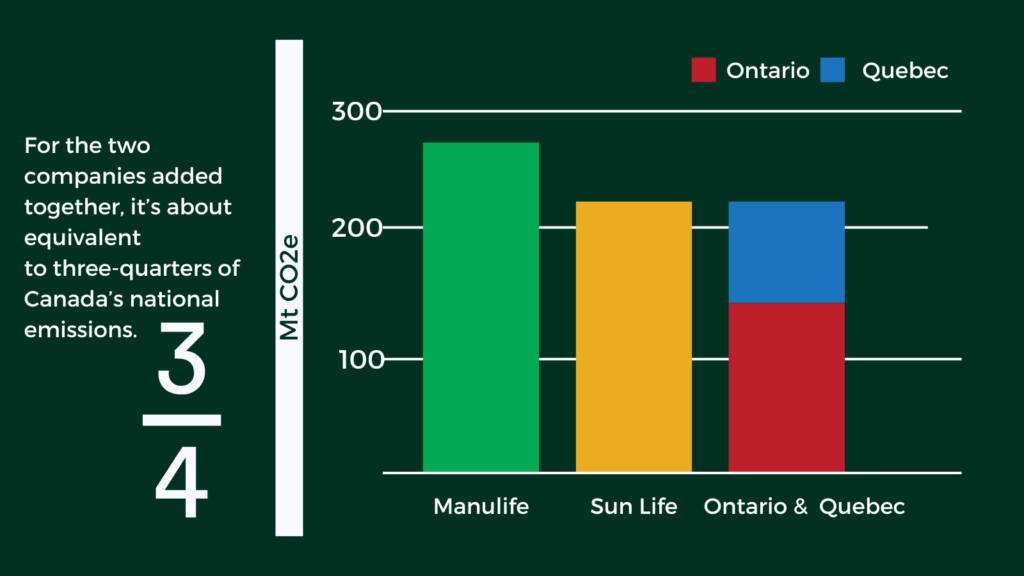

We recently put out a report on Sun Life and Manulife’s financed emissions and their efforts to reach net zero in their portfolios. We commissioned Profundo to estimate their emissions and the results were shocking – each company has financed emissions equivalent to about the overall emissions from the provinces of Ontario and Quebec combined! Sun Life and Manulife are also the number one and three Canadian investors in coal, respectively.

What makes insurance companies do this? Why do their asset management divisions invest in ways that undermine the mission of the company?

There may be no better answer than “everyone is doing it.” That is, asset managers simply seek to maximize profits, and fossil fuels can be profitable, but this is an increasingly untenable position given that the costs of using fossil fuels are rapidly coming due, and it’s insurance companies getting many of the bills.

To their credit, Sun Life and Manluife have committed to getting to net zero in their portfolios and are in the early stages of putting policies in place to get there. But, we are yet to see comprehensive financed emissions reporting, target setting for all portfolios, and robust policies that are going to advance those targets. In particular, we are waiting for more accountability with regards to their fossil fuel investments.

Let’s see if the insurance industry is serious about repositioning itself in the face of the climate crisis. Its future depends on it.