Insurance companies are on the front lines of the climate crisis. This is most evident with property insurers who end up picking up the tab following extreme weather events - hurricanes, fires, floods, etc - and is behind the reason that these companies are lobbying for better adaptation policies in Canada.

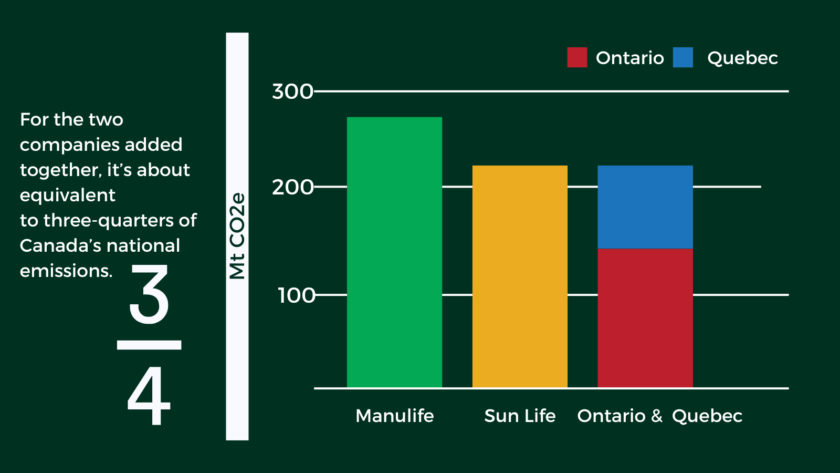

But it’s also true…